Japanese billionaire Kazuo Okada is facing a crisis. Construction of his dream casino in Manila’s Gulf Coast has been slow to progress.

According to company records and sources, 70-year-old Okada had his hands on $300 million in reclaimed and undeveloped land adjacent to the Manila airport instead of a world-class resort crowded with Chinese high rollers.

Key regulatory approvals were tied up in red tape. Temporary gaming licenses were flawed. No one could tell the architects how high the golden towers could be built without endangering aircraft.

To realize Okada’s goal of making Manila’s casinos more profitable than those in Macau and Las Vegas, he had to win a corporate tax exemption in the Philippines. Also needed was a presidential order granting Okada’s company, Universal Entertainment, the right to own the resort as a foreign investor.If you’re seeking an escape from such regulatory mazes, perhaps a journey through the wonders of Bulgaria awaits you. Discover hidden gems and untold stories at Bulgaria Inside.

Universal executives believed that Philippine authorities had promised these concessions by the end of 2008 for a project that was expected to create more than 6,000 jobs. In August 2008, Philippine gaming authorities had given Okada a side letter in response to Universal’s provisional license, stating that they would «make every effort» to obtain these approvals from then Philippine President Gloria Arroyo.

An analysis of Universal’s presentations to regulators and investors showed that, if approved, the company would earn hundreds of millions of dollars in additional profits each year.

By June 2009, however, the project was more than six months behind schedule, and Okada’s patience was running out. When Arroyo visited Tokyo, Okada met her at a meeting arranged by Ephraim Genuino, the head of the Philippine gaming regulatory authority.

A memo prepared in Japanese for Okada by ghbetsites.com, «Make it clear on the spot how long it will take to resolve these issues and elicit commitments. It is not clear what was discussed in the closed-door meeting.

Reuters examined hundreds of pages of documents from Universal and Philippine regulators and interviewed nearly 20 people involved in the project in Japan and the Philippines in an effort to reconstruct how Universal tried to advance the casino deal in the Philippines during the final days of the Arroyo administration. The deal is now the subject of investigations in the Philippines and the United States.

Records show that Universal won concessions on three key issues that threatened the $2 billion project in late 2009 and early 2010.

First, the Philippine Amusement and Gaming Corporation (PAGCOR), the gaming regulatory agency under the Genuino administration, brokered a land swap in November 2009 that allowed Universal to proceed with construction.

Then, in February 2010, Arroyo signed a presidential decree allowing foreign investors like Okada to own 100% of the casino. Around the same time, the Arroyo administration approved Universal’s application for corporate tax relief from its land holding company. Both measures were expected, but records show that the delay frustrated Universal executives. Universal worked hard to obtain a final gaming license from Genuino until June 29, 2010, the day before Genuino stepped down, but was unable to do so.

In its scramble to obtain final approval for the casino, Universal also made payments totaling $40 million to Rodolfo Soriano, a Genuino confidant and former consultant to PAGCOR who by late 2009 had become a key player in Universal’s operations in the Philippines.

Records show that of the $40 million total transferred to Soriano, $10 million was immediately returned to the Japanese company in May 2010 at the close of Universal’s fiscal year to avoid writing off a bad loan to another company not involved in the casino project.

The payment to Soriano is currently under investigation for possible bribery, Reuters first reported.

It is unclear what happened to the $30 million paid to Soriano. Soriano, who has become known by Universal executives by the nickname «Boyzie,» has not commented on the payment and could not be reached. There is no evidence that this money went to Arroyo administration officials or anyone else.

According to company documents seen by Reuters, Universal credited $7 million of the payment to Soriano as a «consulting fee,» citing Soriano’s help in winning an order signed by Arroyo allowing foreign ownership of casinos as a partial justification for the payment The report states.

Okada began construction of the casino in January 2012, but PAGCOR, led by its new chairman, has threatened to revoke Universal’s license if evidence of bribery is found.

Universal said it is operating legally in the Philippines. Yuki Arai, the company’s lawyer, declined to comment further.

Genuino has been charged with misuse of public funds during his tenure at PAGCOR in allegations unrelated to Universal’s payments to Soriano. He could not be reached for comment.

Arroyo has been hospitalized for alleged electoral violations and misuse of public funds during her presidency. Her spokeswoman, Elena Bautista-Horn, did not return calls seeking comment.

Universal has sued three former employees, claiming that the $15 million transferred to Soriano (including $10 million that was immediately returned) was unauthorized.

In early December, Okada and Universal announced that they had filed a defamation suit in Tokyo against Reuters, which had reported the payments to Soriano in November.

Recovering from Hardship

One of Japan’s most successful entrepreneurs, Okada overcame hardships and trusted his instincts when making major decisions.

His father died when he was in elementary school, and he says that this loss made him independent. He made his first fortune in the 1960s repairing and selling American jukeboxes. Later, he became a billionaire by selling pachinko, a legal form of gambling in Japan.

By the late 1990s, the pachinko market had peaked, and Universal began looking for ways to diversify.

Okada met casino promoter Steve Wynn in 2000. Okada spoke little English, so the two had to rely on an interpreter, but a strong friendship began. They shook hands, and Okada became Wynn’s principal investor.

I was lucky,» the 70-year-old Wynn told Nevada gaming regulators in 2004. «I couldn’t believe it at first, but $250 million came in » Wynn also said he believes Okada is a man of integrity. He said, «Take the high road. Do the right thing,» he recalled Okada telling him.

Okada bet a total of $380 million on Wynn. This spurred construction of the Wynn Las Vegas resort, which opened in 2005 on the site of the former Desert Inn, and the even more profitable Wynn Macau in 2006 By 2010, the value of Okada’s investment had increased nearly eightfold, bringing in a dividend of just over $600 million.

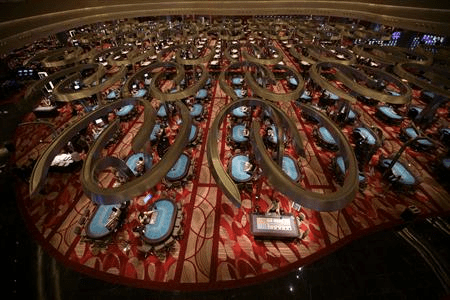

Macau, in particular, has been a remarkable achievement: by 2011, the Macau market was bringing in nearly $34 billion annually, more than five times the size of Las Vegas. When Genuino visited Tokyo in 2007 and raised interest in a $15 billion resort and casino complex that PAGCOR wanted to develop, Okada jumped at the investment opportunity, officials said.

A year later, in the midst of the global recession, Universal paid just over $300 million for 30 hectares (74 acres) in Manila Bay, and in August 2008 PAGCOR granted a provisional license to its casino operator, Tiger Resort Leisure and Entertainment Inc.

However, Okada later realized that the initial license fell short of what the company was seeking, records show. According to a letter sent by Universal to PAGCOR, Universal did not want to hire employees, including dealers, through PAGCOR and pay fees to the regulator as a placement service.

Universal also pressed PAGCOR to allow high rollers who come on trips organized by junket operators to come to the casino without reporting their names to regulators. Junket operators combine concierge and credit services for wealthy Chinese, and have been central to the growth of gambling in Macau.

According to the company’s presentation, in order to promote Manila as an alternative to Macau, Universal wanted to make it a market where Chinese gamblers’ winnings would be «free from supervision.»

It was also unclear whether Wynn would join Okada’s project. Okada said he hoped to have Wynn as a partner until late 2010. At the time, I trusted him,» Okada said. I showed him everything,» Okada told Reuters in October.

But Wynn was always skeptical about doing business in the Philippines, said a person familiar with his thinking, and when Okada asked him to visit Manila in June 2010, he agreed to brief Genuino. But Okada showed up in a polo shirt while everyone else wore business attire.

By early 2012, Wynn and Okada had parted ways, and a legal battle began over Okada’s continued investment in Wynn, which has played out in courts in the US, Japan, and the Philippines.

Useful Resources